Investors’ Focus Shift to Eurozone

Last week the EUR/USD pair had rallied after the European Central Bank President Mario Draghi announced a new bond-buying program to ease the borrowing costs of the debt-plagued countries and to contain the eurozone debt crisis. Disappointing jobs data from the United States was another element effecting the pair. EUR/USD closed the week above the 1.28 handle for the first time since May. There is no big event on Monday but rest of the week will probably be heavy. The German Constitutional Court will rule on whether its Constitution would have to be changed to allow Germany to participate in a European fiscal union. Dutch elections on September 12 and EU finance ministers’ meeting on September 14 have potential to cause high impact on the Market. Thursday also sees a potentially market-moving U.S. Federal Open Market Committee meeting.

Weaker-than-expected U.S. jobs data fueled investor bets that the Federal Reserve will launch another round of monetary stimulus for the world’s biggest economy. If we get larger-than-expected QE from the U.S. then it is good for the equity markets and risk assets, but it will weaken the USD against its counterparts. Despite political opposition and some internal dissent, economists said a weak report on jobs growth for August was likely enough to convince the U.S. central bank a looser monetary policy was needed.

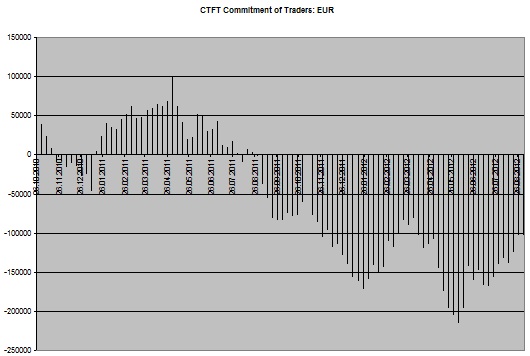

The latest data released by the Commodity Futures Trading Commission showed that speculative traders increased their open short EUR position by only 1% from a week earlier to reach a net of $16.1 billion. According to the Commitment of Traders report, speculative traders also turned net long on USD again with a modest position of $694.4 million compared to a net short position of $1.59 billion a weak earlier. They also increased their open long JPY position by 12% to reach a net of $3.8 billion.

EUR/USD is trading at 1.2778 by the time of typing and for today resistances are located at 1.2823 and 1.2850. Support levels are 1.2764 and 1.2700.

GBP/USD is at 1.6002. Resistance levels are located at 1.6035 and 1.6090. Supports are located at 1.5982 and 1.5956.

USD/CHF is trading at 0.9466 by the time of typing and for today resistances are located at 0.9480 and 0.9516. Support levels are 0.9442 and 0.9408.

AUD/USD is trading at 1.0351. Resistances are located at 1.0380 and 1.0420. Support levels are 1.0330 and 1.0280.

The economic calendar is loaded with the medium impact events. Japanese BSI Manufacturing data will be released at 00:50 GMT. Australian Business Confidence report will be released at 02:30 GMT. UK Trade Balance figures will be released at 09:30 GMT. US Trade Balance and Canadian Trade Balance data will be released at 13:30 GMT.

Comments