Euro Slid and the US Dollar Rebound as Bearish Bets Reached Record Level

The US Dollar rebounded slightly after generating the largest monthly drop in a decade as the greenback struggled due to investors’ concerns over the economic situation of the world’s largest economy.

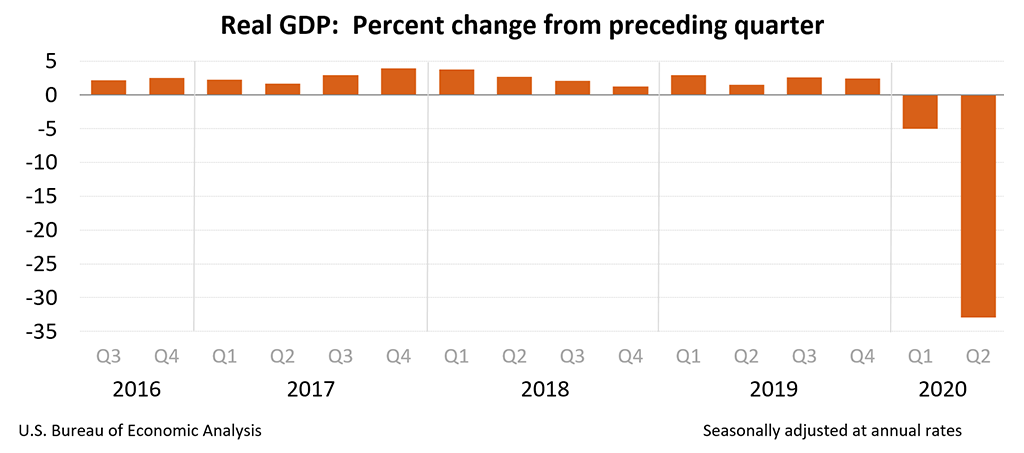

The US economy shark by 32% during the second quarter for the first time in recorded history.

The coronavirus pandemic has been accelerating in the United States over the past couple of months. Although the country has lifted lockdown restrictions, several states are still working on smart lockdowns to reduce the virus spread.

The US dollar has lost 4.1% of value in the last month alone. The dollar index last week plunged to the worst level since May 2018 against the basket of major currencies. The dollar index rebounded from previous lows.

The Euro, on the other hand, has surged to more than two years high against the US dollar last week. The common currency received support from the EU stimulus deal and lack of trader’s confidence in the US economic recovery.

Minori Uchida, chief currency analyst at MUFG Bank says that the common currency hit a speed bump last month with a long position reached a record level.

“But the dollar’s decline is likely to continue. Real U.S. interest rates are declining even as the country is running a big current account deficit, a situation we hadn’t have for a long time,” Minori Uchida added.

The market analysts claim that the EUR/USD pair is likely to experience some selling pressure because bearish positions on the greenback have hit the highest level since April 2018.

The US Commodity Futures Trading Commission data show net bearish bets on the greenback increased to more than $24bn, representing the fourth straight week of jump in bearish bets.

The GBP to Euro exchange rate advanced last week. This week’s British Pound performance depends on key UK data and the Bank of England’s August policy decision.

Comments