Forex Weekly Technical Analysis – 07/01/12

EUR/USD Technical Analysis

EUR is getting weaker and weaker against most of its major counterparts.

As investors don’t see any signs of improvement in the eurozone, they don’t want to buy the euro. They also don’t want to be holding Europe’s common currency when the market expects downgrades from S&P and other rating agencies. The latest economic reports showed that the U.S. economy is in a better condition than forecasted.

When we look at the price action, we can see that USD bulls are in charge and they are trying to drag the pair down. I think that EUR/USD is heading to an important support level at 1.2520 and 1.2634 is the previous (minor) support level.

However, if the pair can get back above 1.2770, we can talk about a retracement possibility towards 1.2967 level. The latest CTFC (Commitments of Traders) report shows that the currency speculators increased their net short positions to record highs. They increased their net short EUR positions by 11K contracts to 138.9K.

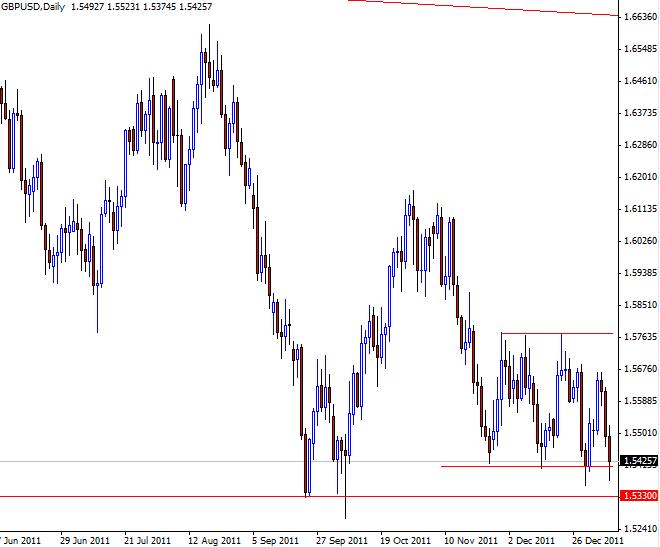

GBP/USD Technical Analysis

GBP is rather strong compared to EUR. EUR/GBP is in free fall and therefore it is slowing things for GBP/USD. Technically speaking, if the pair can’t get back over 1.5484 it may definitely move to 1.5330 and 1.5185.

Daily close over 1.5484 / 1.5500 indicates that GBP/USD will not give up that easy and it will try 1.5675 level again before it heads lower.

The latest CTFC Commitments of Traders report showed that the currency speculators increased their short positions slightly. They increased their net short GBP positions by 2.7K contracts to 31.9K.

Comments