Forex Weekly Technical Analysis – 15/01/12

EUR/USD Technical Analysis

After S&P lowered its long-term ratings on nine eurozone sovereigns, the bears manage to take the reigns and pushed EUR/USD back to 1.2625 zone. The pair closed the week at 1.2682. Price is also currently slightly above an important support at 1.02660, which once broken will signal a further breach. With the overall attitude in the markets, there is a good chance this pair will fall further.

If things turn bullish, we will see resistance at 1.2770 and 1.2890. above that. If the downward pressure continues, look for support in the 1.2660 area, then 1.2550/1.2505 and again at 1.2430.

The latest CTFC (Commitments of Traders) report shows that the currency speculators increased their net short positions to record highs. They increased their net short EUR positions by 16.3K contracts to 155.2K.

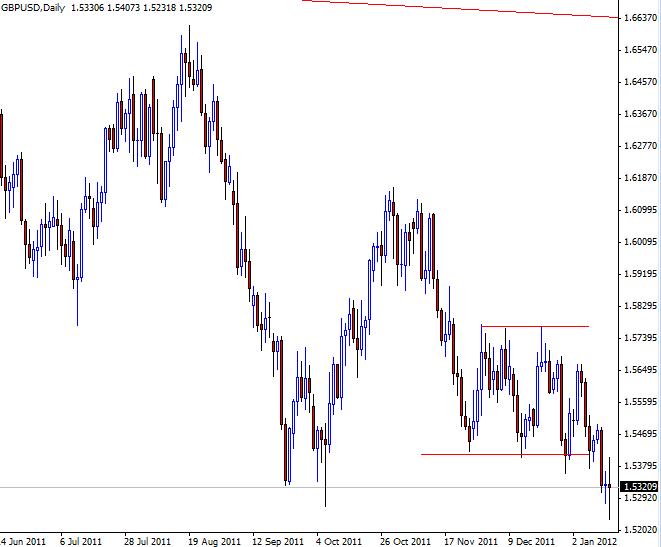

GBP/USD Technical Analysis

According to the weekly charts, the pair is still bearish and I expect that the trading range this week will be between 1.5400 and 1.5123. If GBP/USD can’t find a good support at those levels, its descending to 1.5000 area will accelerate.

On the daily chart, we can see that the pair found some support at 1.5230 and pushed higher. However, 1.5400 support is broken and trading below this level will make technically hard for GBP/USD to rise.

The more likely scenario is that we will continue to see the price fall with traders testing the support zone at 1.5123 but before this happens the pair may test the strength of 1.5400 resistance one more time. If price follows through with the bullish reversal, I will be looking for 1.5540, then 1.5670.

The latest CTFC Commitments of Traders report showed that the currency speculators increased their short positions slightly. They increased their net short GBP positions by 3.9K contracts to 35.8K.

Comments