U.S. Stock Market Outlook Strengthens as Economic Plunge Has Passed

All three U.S. stock market indices ended the last week in a green as investors believe worst is over and economic activities have started returning to normal.

Disney’s announcement of the reopening of its China theme park along with the reopening of Apple stores across the world bolstered analyst’s sentiments. Crude oil prices jumped close to 25% last week on hopes of improving demand and slowing supplies.

The S&P 500 grew almost 30% from lows that the index had hit in March, down only 13.6% from its record February high.

Meanwhile, the Nasdaq Composite jumped close to 35% from March lows, driven by strong gains from big tech companies, including Facebook, Alphabet, and Amazon.

“It’s amazing really given we’re still working from home,” said JJ Kinahan, chief market strategist at TD Ameritrade, about the average clawing back its 2020 losses. “Our reality is we’re working from home and some of the economic demand would seem to be less, yet these stocks continue to fight through.”

The stocks are likely to perform well in the days ahead as several analysts believe the market has hit the bottom.

Governments all over the world have eased their lockdown restrictions, permitting businesses to operate with new protocols that include lowering capacity and healthcare measures at business spots.

“Right now, what investors and traders are looking at, not to mention public health officials, is how it is working in other countries,” she said.

“When you watch other countries opening and doing it successfully without an uptick in cases, it portends well for the U.S.”

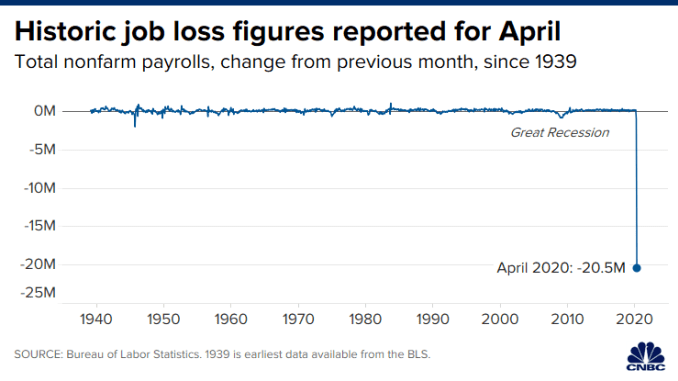

The U.S. president has been aggressively looking to reopen the economy in order to reduce the threat of recession as a record 20.5 million American have lost their jobs last month amid pandemic, pushing the unemployment rate to 14.7%.

Comments