A Minor Detour – Snapshot of the Financial Blogosphere

For those suffering from QE2 fatigue, the following might numb the pain a little.

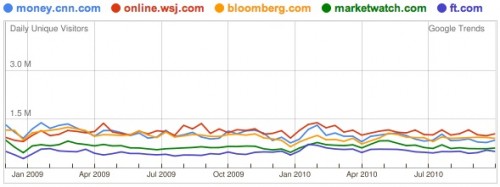

We have been investigating visitor behaviour patterns at various financial websites recently. Out of this has fallen the following snapshot of the blogosphere (broadly defined and with the following data drawn exclusively from Google Trends). It’s not meant to be exhaustive – more a quick diversion.

Newscorp’s got the moves

Apologies for the useless scaling – send your optician’s bills to Google. Given that the WSJ Digital Network includes MarketWatch (3.5m uniques per month), Bloomberg (5.6m) and the Journal (7.5m), Newscorp’s got its paws all over the big end of town. It’s interesting that the Journal has outperformed Bloomberg by visitors (different business models but suggests that the Journal is having some success despite its paywall). CNNMoney (5.6M) is slipping quietly behind. FT.com (3.8m) is included as a point of reference. Sure the UK doesn’t have the population of the US, but the pink sheet is making slow progress. It’d be remiss not to mention YahooFinance with 5.0m daily uniques or 31m unique visitors per month – doing just fine thanks.

The understudies and the contenders

It’s the Western conference versus the East, and the Business Insider is looking the goods over Seeking Alpha. Perhaps the self-help, cult of the amateur model is struggling with the sheer volume of content. Expert curation has its merits in an information-laden environment. The more traditional journalism of The Street even looks to be pulling away.

While looking to the next layer of aggregated content providers, Zerohedge is the clear winner. Its smoky blend of conspiracy theory, expert insights and outright inflammatory rhetoric make for entertaining reading and an engaged audience. In contrast, the likes of Financial Sense and Minyanville seem to be struggling under its own weight. (Note that Abnormal Returns has managed to extricate itself from the Google web.)

The Blogs

Even the most charismatic of bloggers strain to make an impression on the Google worm-o-meter. Barry Ritholtz has forged a path that few can follow. On a check of other high profile bloggers, there looks to be a trend towards a gradual decline in the audience (the purple line is Mish’s Global Economic Trend Analysis). Some of my favourite sites barely register (The Pragmatic Capitalist, A Fistful of Euros, and Credit Writedowns to name a few). So much for emergent democracy.

Raw data and lines

Let’s hope then that the vanguard of open source data – including Google and Yahoo – continue to make it freely available. This is a growth sector so there are reasonable odds that the likes of Finviz and FXStreet achieve the scale required to maintain independence while still being able to evolve their offerings. Still, with role models like the LME out there, it’d be fair to expect some media mogul to seek to patent the human genome at some point. Until then Vive le revolution.

And the Chartists

No, not the 19th-century revolutionaries – these are the descendants of the Delphic Oracles or perhaps the forerunners of the second Foundation.

It speaks volumes for the dark arts that a site like Elliot Wave International can grow its following even as the ‘timing’ of some of its calls has proven rather wayward. Perhaps the descent of The Slope of Hope (a great site by my reckoning) is indicative of the same malaise that is striking at other blog sites – simply a declining interest in the financial markets.

One final curiosity – dhsort’s Great Depression analogues burned bright but you can only have so much of a good thing I suppose.

Comments